The Goods and Services Tax (GST) regime has transformed India’s tax landscape since 2017, yet its application to legal professionals remains widely misunderstood. At Rajendra Law Office LLP, we frequently counsel lawyers and law firms on this critical issue: Are you legally required to register under GST? The answer is nuanced—it depends entirely on your practice structure, client profile, and revenue sources. This definitive guide demystifies GST obligations for Indian legal practitioners.

Key Determinants of GST Registration for Lawyers

1. Your Professional Category

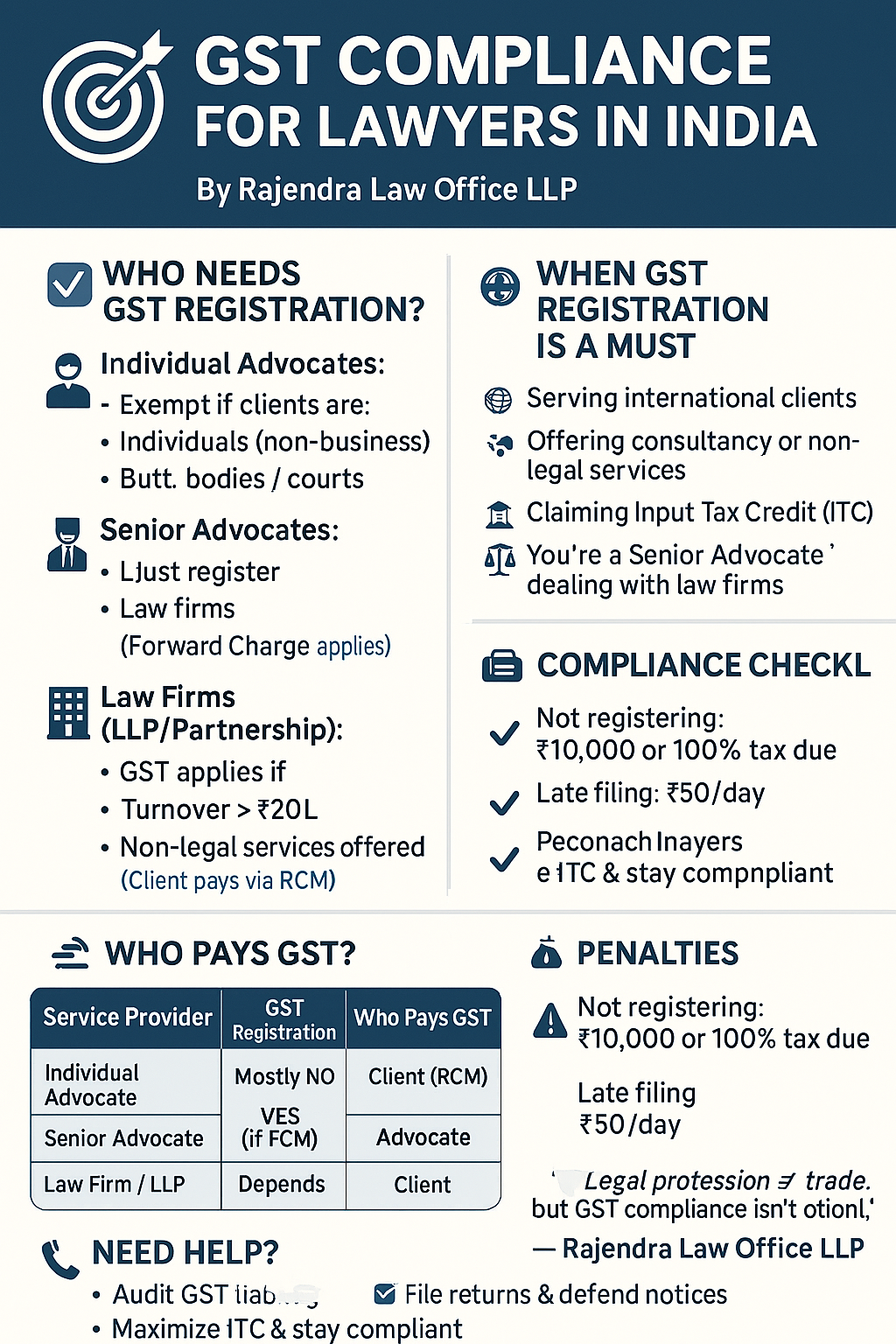

The GST framework treats legal professionals differently based on their designation and practice model:

- Individual Advocates: Generally exempt from GST registration when serving:

- Non-business individuals

- Entities with turnover < ₹20 lakh (₹10 lakh in special category states)

- Government bodies or courts

- Senior Advocates: Must register if serving other advocates/law firms. Exempt for services to non-business entities.

- Law Firms (LLPs/Partnerships): Treated like individual advocates unless providing non-legal services.

2. Client Profile & Service Nature

GST liability hinges on who pays you:

- Business Clients (Turnover > ₹20 lakh):

- GST applies at 18% under Reverse Charge Mechanism (RCM). The client pays GST—not you.

- Example: A corporate client pays your ₹50,000 fee + ₹9,000 GST directly to the government.

- Non-Business/Exempt Clients: No GST applies.

3. Revenue Thresholds

Registration is mandatory if annual turnover exceeds:

- ₹20 lakh (₹10 lakh in Northeastern/hill states)

Note: Turnover calculation excludes RCM services and exempt supplies.

Critical Scenarios: When Registration IS Required

- You’re a Senior Advocate Serving Law Firms: Forward Charge Mechanism applies—you must charge, collect, and remit GST.

- You Provide Non-Legal Services: Consultancy, mediation, or advisory work nullifies exemptions.

- You Serve International Clients: Export of services is “zero-rated”—registration is mandatory to claim Input Tax Credit (ITC).

- Voluntary Registration: Useful to claim ITC on office rent, software, travel, etc.

GST Compliance Roadmap for Legal Professionals

Assess Your Liability: Step 1

| Practice Type | GST Registration Required? | Who Pays GST? |

|---|---|---|

| Individual Advocate | Only for exports/non-legal services | Client (via RCM) |

| Senior Advocate | When serving other lawyers | Advocate (FCM) |

| Law Firm (LLP) | If turnover > ₹20L or non-legal work | Client (RCM) |

Registration Process (If Applicable): Step 2

- Submit via Form GST REG-01 on the GST Portal

- Documents required: PAN, Aadhaar, address proof, bank account details, photograph

Ongoing Compliance: Step 3

- Invoicing: For registered lawyers, must display:

“GST payable by recipient under RCM” - Returns: File GSTR-1 (outward supplies), GSTR-3B (monthly/quarterly), GSTR-9 (annual)

- ITC Claims: Allowed on business-related purchases like rent, IT tools, or outsourced services

Penalties for Non-Compliance: A Stern Warning

- Failure to Register: 100% of tax due or ₹10,000—whichever is higher

- Incorrect Filing: ₹50/day (₹25 CGST + ₹25 SGST)

Recent Case Law: Orissa High Court quashed blanket GST notices to lawyers, reinforcing exemption scope for individual practitioners.

Why This Matters for Your Practice

- Cost Savings: Avoid penalties with correct RCM classification

- Competitive Edge: Claim ITC and optimize operational cash flow

- Client Trust: Transparency in invoicing and compliance builds long-term credibility

“The Constitution distinguishes legal practice from trade—yet GST compliance remains non-negotiable where applicable.”

– Rajendra Law Office LLP Tax Advisory Team

FAQs: Quick Clarity from Our GST for Lawyers Experts

Q1. Do solo practitioners need GSTIN?

Rarely—only if serving foreign clients or exceeding turnover limits.

Q2. Can a law firm ignore GST if revenue is below ₹20L?

Yes, unless they serve international clients or offer non-legal services.

Q3. What SAC code applies to legal services?

SAC 9982 (Legal and Accounting Services) – GST @18%.

Q4. Are arbitration and mediation services taxable?

Yes—18% GST applies unless offered to exempt entities.

Conclusion: GST for Lawyers Partner with Precision

GST for lawyers isn’t one-size-fits-all. While individual advocates enjoy broad exemptions, senior advocates and firms must tread carefully. At Rajendra Law Office LLP, we help you:

- Conduct GST liability audits

- Manage registration, invoicing, and return filings

- Respond to tax notices or disputes with confidence

Act Now: Ensure GST compliance without overpaying. Contact our GST specialists for a confidential consultation.

Read More

- Extradition Laws in India: Supreme Court’s Role in High-Profile Cases

- Supreme Court on Citizenship Rights: Recent Landmark Judgments

- Pension Disputes and Employee Welfare: Supreme Court Precedents

- GST Legal Services in Chennai – Advisory, Litigation & Dispute Resolution

- GST Legal Experts in Chennai: Notice Response, Audit Defense, Appeals, Refunds, Penalties, Registration, Compliance & Court Representation